Litigators of the Week: Robbins Geller Lands $490M Securities Settlement in Case Over Apple’s Prospects in China

By Ross Todd

The AmLaw Litigation Daily

Reprinted with permission from ALM.

September 27, 2024

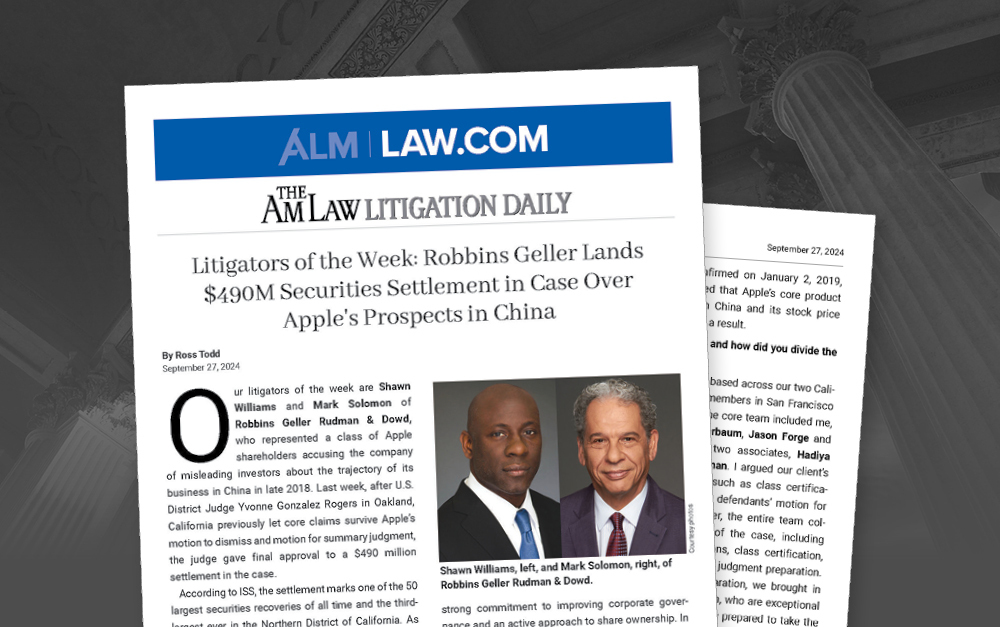

Our litigators of the week are Shawn Williams and Mark Solomon of Robbins Geller Rudman & Dowd, who represented a class of Apple shareholders accusing the company of misleading investors about the trajectory of its business in China in late 2018. Last week, after U.S. District Judge Yvonne Gonzalez Rogers in Oakland, California previously let core claims survive Apple’s motion to dismiss and motion for summary judgment, the judge gave final approval to a $490 million settlement in the case.

According to ISS, the settlement marks one of the 50 largest securities recoveries of all time and the third- largest ever in the Northern District of California. As you’ll read below, the Robbins Geller lawyers achieved this outcome even though they weren’t initially tapped as lead counsel.

Litigation Daily: Who was your client and what was at stake here?

Mark Solomon: Our client was Norfolk Pension Fund, a public pension fund in the United Kingdom. Norfolk acquired Apple shares during the relevant period and suffered significant losses as a result of the alleged misrepresentations. The fund has a strong commitment to improving corporate governance and an active approach to share ownership. In the United Kingdom, there’s a Stewardship Code that defines the wider duties of asset owners and institutional investors, which an increasing number of U.K. pension funds believe includes seeking appropriate redress on behalf of their members and beneficiaries when serious fraud or other financial misconduct has taken place. While other investors might have reasonably sought to resolve the case earlier on less favorable terms, Norfolk was determined here to see a substantial recovery for all injured shareholders in what appeared to the stewards of the fund to be a strong case of securities fraud.

What was the alleged misstatement at the heart of this case? And how do you allege that it propped up the price of Apple stock?

Shawn Williams: In late 2018, the market was closely monitoring Apple’s business performance in China. During the investor call, an analyst specifically asked Tim Cook to discuss the current state and trajectory of Apple’s business in China in light of the ongoing economic slowdowns occurring in some emerging markets. Cook reassured investors, explaining that while Apple wasn’t growing “the way we would like to see” in certain emerging markets, “I would not put China in that category.” These words were critical as Apple had just released a new iPhone targeting the Chinese market. Just days later, reports emerged that certain manufacturers had cut production for the latest iPhone, and on January 2, 2019, Apple issued a warning that its first quarter of fiscal 2019 revenue would fall well below forecasted expectations due to weak demand in China.

Apple strongly denied that Cook misled investors, and throughout the litigation and in our resolution, the company made no admission of wrongdoing. Apple argued that we had misinterpreted Cook’s comments and that he was referring to the company’s performance in China during the prior quarter and discussing the impact of currency devaluations in other emerging markets, not current demand for Apple products.

Our view was that Cook’s statements were clear: he was specifically addressing both the current conditions in China and what that meant for its future prospects for Apple’s business there. We argued that Mr. Cook already knew iPhone demand in China was weak when he told investors that China was not in the category of emerging markets where Apple was experiencing pressure. This was crucial to investors as analyst reports immediately repeated Cook’s remarks. This was confirmed on January 2, 2019, when the market learned that Apple’s core product was underperforming in China and its stock price immediately declined as a result.

Who was on your team and how did you divide the work on this case?

Williams: Our team was based across our two California offices, with most members in San Francisco and some in San Diego. The core team included me, Mark, partners Dan Pfefferbaum, Jason Forge and Kenny Black, along with two associates, Hadiya Deshmukh and Jacob Gelman. I argued our client’s case during key hearings, such as class certification and the hearing on the defendants’ motion for summary judgment. However, the entire team collaborated on every aspect of the case, including discovery motions, depositions, class certification, expert analysis and summary judgment preparation. As we moved into trial preparation, we brought in our in-house trial support team, who are exceptional at what they do, and were fully prepared to take the case to trial.

I want to acknowledge the highly skilled lawyers defending Apple, for whom I have a great deal of respect. Jim Kramer of Orrick and Melinda Haag and Dan Kramer of Paul Weiss are some of the best lawyers in the country. We had a strong team that truly enjoyed sparring with and testing its mettle against terrific opposing counsel.

Judge Gonzalez Rogers noted in the order granting final approval to the settlement that you were not the original lead counsel on this matter. Can you explain how you became the lead? You filed a response to Apple’s motion to dismiss even though you weren’t lead at the time, right?

Williams: We had never seen an order like this, which is saying something because we have been doing this, collectively, for many decades. Judge Gonzalez Rogers’s ruling was unprecedented and I think it will be looked at very thoughtfully and productively by other courts because of the end result in the case.

To understand her order, first a bit of context . . .

Any shareholders may file a class action when they believe a company has committed securities fraud and assert the time period in which they believe the fraud occurred. That’s called the “class period.” In January 2019, when Apple disclosed weakening iPhone demand in China, several investors filed complaints of varying class periods. Thereafter, in conformity with the Private Securities Litigation Reform Act of 1995, the “PSLRA,” any investor that believes they have the largest financial losses in the alleged class period can file a motion to be appointed the lead plaintiff and prosecute the case on behalf of the entire class.

The court then carefully evaluates the various motions for the appointment of lead plaintiff and determines which investor is best suited to represent the class. Critically, the PSLRA requires the court to appoint the plaintiff-shareholder with the largest financial loss in the alleged class period.

In Apple, we originally filed a securities fraud complaint, alleging an approximately two-month class period focused on the representations concerning Apple’s business in China. Another investor filed a case with a class period of over two years, which included additional allegations about Apple throttling iPhone batteries years earlier. We argued that the two-month class period was superior because it was tightly focused on the issue that caused investor losses and that the two-year case included various unrelated allegations that could not survive a motion to dismiss—and that the larger loss resting on those additional allegations, as a result, was illusory.

At the hearing on the competing motions for lead plaintiff, Judge Gonzalez Rogers expressed her reservations about the two-year complaint, stating that she was “not very impressed with the strength of the claims . . . in the . . . longer class period.” However, the court felt bound by the statute to appoint the plaintiff with the largest losses in the class period on file. In a prescient move, she stated that “[i]f you [Robbins Geller and Norfolk] think the opposition to the motion to dismiss is insufficient, you may submit . . . [a brief] explaining to me why you think it doesn’t and requesting the ability to brief whatever it is you want to brief.”

That’s what we did. With the court’s permission, on behalf of Norfolk, we filed a request to submit additional briefing in connection with the defendants’ motion to dismiss. We argued that the core allegations against Cook were, in fact, the only viable portion of the case.

On June 2, 2020, the court issued an order granting the defendants’ motion except for two statements made by Cook during our shorter class period. In denying the motion with respect to those two statements, the court credited the arguments advanced in our brief and stated its intent to reconsider the motion for lead counsel, as discussed at length with counsel.

We expect more courts to look at this approach in appropriate circumstances.

She also noted in that order that portions of this case were “uniquely complex.” What elements of the case would you characterize that way?

Solomon: The defense litigated this case with gusto, and we had to tackle several complexities. The issue of loss causation turned out to be a key defense for Apple. The company had issued revenue and earnings guidance concurrently with the alleged misrepresentations concerning China. Apple said that share prices sank because the company had missed its financial projections for the quarter, not because of any prior false statements. It was our task to trace the losses to the China statement itself.

The correct interpretation of Cook’s statement itself was perhaps the most hotly contested issue. Apple argued that Cook’s statement wasn’t addressing current business or demand for iPhones in China at all; he was only discussing past performance and how foreign currency fluctuations affected emerging markets. They also contended that he was expressing an opinion, not stating a fact. While factual statements are actionable under securities laws, opinions are subject to a much more complex analysis following the Supreme Court’s decision in Omnicare. Since then, it’s been common for defendants to recast nearly any statement as an “opinion.” Courts are rightly skeptical of this, and here, the court recognized at the motion to dismiss and summary judgment stages that Cook’s comment could reasonably be understood as a statement of fact.

What are the particular challenges of bringing a case like this against Apple?

Solomon: Apple is a different kind of opponent. It’s the size of a large nation, by revenue and market capitalization. And it has a reputation as a fighter. It tried a massive competition case in the same courtroom not long ago in which Cook personally took the stand. Our case alleged that he engaged in fraud, so we knew that they would vigorously defend the case. And they did. But we’ve tried to build the firm so we consistently punch above our weight, and we maintain the kind of scale unique among plaintiffs’ firms that makes it very difficult for any large company to overpower us with the typical deluges of motions and filings. In the end, we believe we prevailed on the key issues against exceptional defense counsel, and I’m proud of my colleagues, aware that Apple is a most formidable litigant.

You had a trial date for this case in May. These cases so rarely make it to trial. Is there part of you that wishes you could have tried this one?

Williams: There’s always a part of you that wants to take the case to trial. We take great pride in trying and winning these cases before juries, and we’ve tried more securities fraud class action cases than any other securities plaintiffs’ firm. However, we fully recognize the risks of going to trial and don’t take them lightly. Sometimes, the best outcome for our clients is a negotiated resolution where they recover a significant portion of their losses while eliminating the risk of receiving no recovery at all. We won’t try a case just for the sake of trying it. In this instance, we had a skilled mediator who helped us reach a favorable result, and I’m very pleased with where we landed.

What can other securities plaintiffs take from how you and your team litigated this case?

Solomon: Focus—the importance of focus. We didn’t boil the ocean in our complaint. We focused our case on the single key statement, its falsity, and the impact on investors when the truth came out. We did our best to keep the case focused and tight. Not every case is like this—some fraudulent schemes are elaborate and involve multiple misstatements resulting in multiple impacts on stock price. But we resisted the temptation to overcomplicate this one. It still became a hard-fought, complex case, but we were able to consistently return to a very straightforward, focused narrative of what this case was about and how our client and other investors were harmed.

What will you remember most about getting this result?

Solomon: The Times (U.K.) ran this headline about the case outcome: “Norfolk humbles the mighty Apple.” Norfolk was unflinching in its prosecution of the case, and our team was determined to deliver the fund an outstanding result.

Williams: The satisfaction of convincing the court that our firm had identified the most appropriate claims and the appropriate class period, which allowed Norfolk to pursue the claims where there were real investor losses that could be recovered.

Reprinted with permission from the September 27, 2024 edition of the AMLAW LITIGATION DAILY © 2024 ALM Global Properties, LLC. All rights reserved. Further duplication without permission is prohibited, contact 877-256-2472 or asset-and-logo-licensing@alm.com. # AMLAW-9272024-58915

To view the original article, click here.

Attorneys

Practice Areas

Read More Firm News

- December 4, 2025

- October 10, 2025

- October 8, 2025

- September 8, 2025

- August 20, 2025