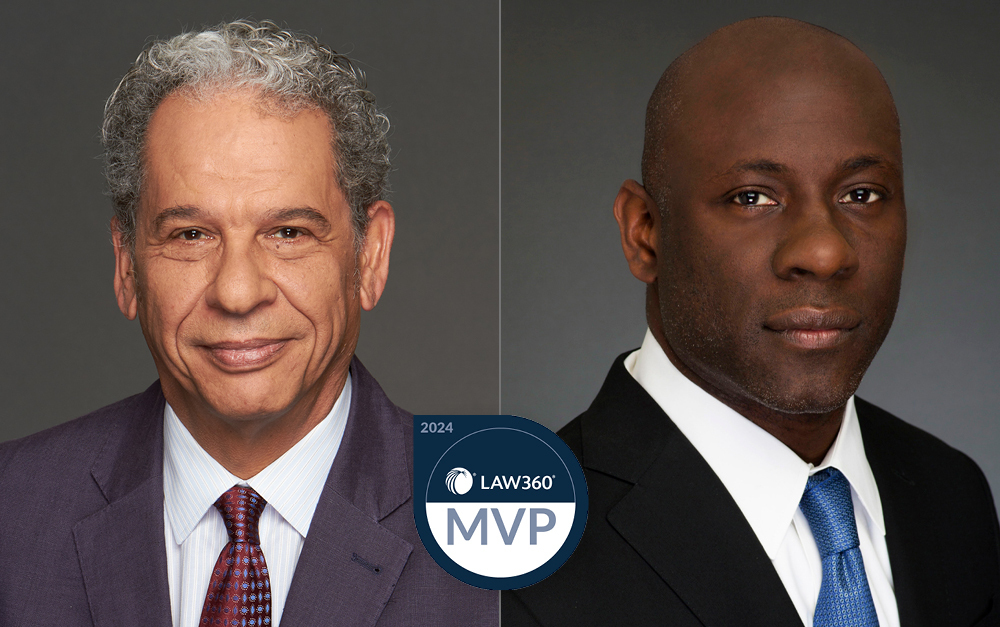

MVP: Robbins Geller’s Shawn Williams And Mark Solomon

By Daniel Connolly

Law360

Article is reprinted with permission from Law360.

Law360 (October 25, 2024, 2:21 PM EDT) -- Shawn Williams and Mark Solomon, managing partners at Robbins Geller Rudman & Dowd LLP, represented a British pension fund in a shareholder lawsuit against one of the deepest-pocketed companies in the world, Apple Inc. After years of litigation, Apple agreed in March to settle the case for $490 million, an outcome that landed both Solomon and Williams on the list of the 2024 Law360 Securities MVPs.

In an interview with Law360, the pair said the Apple litigation outcome is a testament to Robbins Geller’s resources and the quality of its lawyers and support personnel.

“And because we have a number of former prosecutors and even federal defenders, guys and gals who have tried a lot of cases, that when we say that we are preparing for trial, we really mean it,” Williams said. “And that makes a difference in both the timing and the size of the recoveries that we can get for our clients.”

Their biggest accomplishment:

The partners are both based in California — Solomon in San Diego and Williams in San Francisco. Solomon has been in practice for over 35 years, while Williams has been practicing for nearly 30.

In the Apple litigation, the two represented the Norfolk County Council, the administering authority of the Norfolk Pension Fund, which covers pensions for local government retirees and other pensioners in the Norfolk, England, area.

Robbins Geller specializes in security lawsuits and has more than 200 attorneys in 10 offices around the U.S. The firm had previously represented the Norfolk Pension Fund in a successful federal securities trial against Puma Biotechnology Inc., alleging that the company had overstated the effectiveness of a breast cancer drug.

Solomon said that trial, which took place in 2019, helped him build a personal connection to a Norfolk Pension Fund representative — the person from the fund with whom he’d been liaising had attended the trial.

“He had given evidence in the trial itself. He had given the deposition before. He’d overseen our prosecution of the case, and so he had a very positive experience,” Solomon said.

“And it just so happened that Shawn got in touch with me, and I can’t remember the details of how, but he told me that he was looking at the case against Apple, and that Norfolk Pension Fund had a significant loss in the case,” Solomon added.

The lawsuit against Apple also began in 2019, but with a different retirement system — from the city of Roseville, Michigan — as plaintiff. Roseville’s retirement system remained a plaintiff throughout the case but didn’t seek the lead position, Solomon said, and Norfolk Pension Fund later took over that role.

The plaintiffs alleged that, in November 2018, Apple CEO Tim Cook and Chief Financial Officer Luca Maestri had made misleading statements overstating the strength of the company’s sales in China and its financial outlook.

The suit said that, a short time later, in January 2019, Apple unexpectedly announced that sales in China had slowed, and its stock price dropped dramatically. The plaintiffs argued that the defendants had made public misrepresentations and failed to disclose material facts.

In June 2020, Robbins Geller won its bid to act as lead plaintiffs’ counsel in the complex case.

Their proudest moment:

Litigation continued, and the plaintiffs and Apple entered into settlement negotiations.

Those talks took place over multiple sessions, both online and in Newport Beach, California, with former U.S. District Judge Layn R. Phillips acting as mediator.

Williams said it was such a gradual, back-and-forth negotiation process that he doesn’t recall the exact moment he learned the deal was reached.

He said the team was happy with the terms, though he said a pretrial settlement can lead to a feeling of deflation, too, since attorneys are getting ready for a trial.

“I don’t know if I would characterize it as emotional, just sort of we were happy that we were able to put a certain level of risk behind us while also recovering a lot of money for our clients,” he said.

In September, U.S. District Judge Yvonne Gonzalez Rogers approved the $490 million settlement, an amount that included about $110.5 million in fees and costs of litigation to be shared among attorneys from Robbins Geller and Labaton Keller Sucharow LLP.

Solomon said Apple never would have agreed to settle if the plaintiffs hadn’t been willing and able to take the lawsuit to trial.

“You can’t maximize [the value of the case] unless you have a credible, real trial threat and a threat of winning the trial,” Solomon said. “And believe it or not, even though there are hundreds of cases filed every year, there’s probably been less than a dozen cases ever tried successfully to a jury since the [Private Securities Litigation Reform Act of 1995], and only a handful in the last 15 years.”

“We search, in a sense, the best opportunities to try cases, because that’s the only way we want to do it,” Solomon said.

That approach increases the value of all cases, said Solomon, pointing to the $1.575 billion his firm recovered in a case against HSBC’s U.S. subsidiary Household International in 2016, following a jury verdict and on the eve of a second trial, as well as the over $54 million retrieved following the verdict for plaintiffs in the Puma Biotechnology case in Santa Ana, California.

“Taking such cases through trial and taking the likes of the Apple case to the brink of trial demonstrates a commitment and a capability that sends precisely the right message to all of our adversaries,” Solomon said.

Williams said the effort to litigate the Apple case was much harder than it might seem from the outside, and that he and Solomon didn’t do it alone.

A team of about 18 people — attorneys, secretaries, clerks, accountants and other professionals — worked intensely on the case for about five years and often sacrificed time with their families, he said.

“You know, the amount of effort and resources put into presenting something that’s very persuasive, that makes some of the biggest, most powerful and resourced companies in the world say, ‘You know what? We should probably talk about whether we can both reach an agreement here,’” Williams said.

“That’s not easy, and that’s not something that happens overnight,” he added.

Why they’re securities attorneys:

Solomon grew up in Luton, England, which is near London. Between the ages of 18 and 22, he worked as a police officer.

“Having been a police officer, I’d seen in those days in the late ‘70s, early ‘80s, a fair amount of questionable conduct, and just thought that being a criminal defense barrister with the insights I had would be a worthwhile exercise,” he said.

In England, he completed undergraduate studies in law at Trinity College Cambridge and legal studies in London at Inns of Court School of Law — now known as The City Law School.

He ended up leaving the U.K. and coming to the U.S. for a master’s in law at Harvard University, after which he met his wife, qualified for the bar in the U.S. and continued a practice in this country. He got into securities law through defending such cases at Jones Day and Stroock & Stroock & Lavan LLP.

Williams grew up in New Rochelle, a suburb of New York City, and said that even during his early days of college at State University of New York at Albany, he wasn’t sure he would become a lawyer.

“My sister, however, had gone to law school several years before me, and she talked about how much she enjoyed it, and she enjoyed the intellectual challenges of it, and just how studying law kind of changed her outlook on everything,” he said.

He ended up completing law school at the University of Illinois College of Law and returned to Manhattan to work as a state-level prosecutor handling mostly street crimes, and later, financial ones.

He said that job required assistant prosecutors to be independently responsible for their cases.

“You had the responsibility of drafting the complaints, interviewing the witnesses — including police officers and experts — with felonies, presenting those cases to the grand jury and trying the cases,” Williams said.

It helped him build a strong foundation of investigating and preparing cases with the goal of actually trying them, he said.

This foundation would serve him well when he joined a predecessor firm of Robbins Geller in 2000, Williams said.

What motivates them:

“Holding the powerful and corrupt accountable by helping defrauded pensioners is inspiring — and it means there’s never a dull day,” Solomon said.

Williams said, “As I mentioned earlier, I’m motivated by the importance of what we do for our clients and the appreciation we feel when we recover losses for them and their constituents.”

Their advice for junior attorneys:

Both Solomon and Williams said they would encourage young attorneys to consider securities law.

“If they’re thinking about it already, that hopefully is because they’re passionate about it, and if they are passionate about it, then take the brakes off,” Solomon said. “It’s a great practice. You have to work very hard, but if it’s your passion, who cares?”

Williams said, “I think that if you are interested in working on helping people, and you’re not doing work in the sort of traditional public sector, this work can be very rewarding, intellectually challenging and obviously provide a lengthy career doing good.”

“I mean, the people that benefit from the work we do, like Norfolk Pension Fund, these are pensioners. These are regular working-class people who have put their money into pension funds in hopes that that money would grow and be there when they hit retirement age,” Williams added. “And when that sum is negatively impacted by fraud, somebody has got to do something about it in a way that helps to put some of that money back in their pockets. And you know, we strive to do that. We’re pretty good at it. . . . So it can be a rewarding field of practice.”

--As told to Daniel Connolly. Additional reporting by Dorothy Atkins and Jessica Corso. Editing by Melissa Treolo.

Law360’s MVPs are attorneys who have distinguished themselves from their peers over the past year through high-stakes litigation, record-breaking deals and complex global matters. A team of Law360 editors selected the 2024 MVP winners after reviewing nearly 900 submissions.

All Content © 2003-2024, Portfolio Media, Inc.

To view the original article, click here.

Attorneys

Practice Areas

Read More Awards

- November 24, 2025

- July 21, 2025

- July 2, 2025

- June 19, 2025

- March 24, 2025